2024 Form 1040 Schedule 2 Instructions And

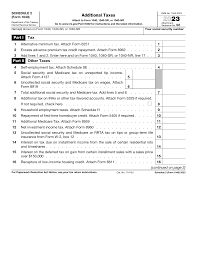

2024 Form 1040 Schedule 2 Instructions And – The Internal Revenue Service (IRS) has announced updates to the Schedule 2 tax form and instructions for the upcoming tax years of 2023 and 2024. TRAVERSE CITY, MI, US, January 13, 2024 . To claim a loss from your small business, you must use Form 1040 as your individual income tax return form and Schedule C to demonstrate expenses in “Part II,” and complete any supporting .

2024 Form 1040 Schedule 2 Instructions And

Source : www.irs.govSchedule 2 line 2 fafsa: Fill out & sign online | DocHub

Source : www.dochub.com1040 (2023) | Internal Revenue Service

Source : www.irs.govForm 1040 Schedule 2 Guide 2024 | US Expat Tax Service

Source : www.taxesforexpats.com1040 (2023) | Internal Revenue Service

Source : www.irs.govIRS Releases Updated Schedule 2 Tax Form and Instructions for 2023

Source : www.wwlp.com1040 (2023) | Internal Revenue Service

Source : www.irs.gov2023 schedule 3: Fill out & sign online | DocHub

Source : www.dochub.comPublication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.govTax season is under way. Here are some tips to navigate it. – KGET 17

Source : www.kget.com2024 Form 1040 Schedule 2 Instructions And 1040 (2023) | Internal Revenue Service: Use Schedule C for sole proprietorships, Form 1120 for corporate tax returns or Form 1065 for partnerships. When allowed, you can carry over business losses to your Form 1040 from Schedule C or . Form 1040-SR uses the same line items and instructions as the Standard Form such as Schedules 1, 2, and 3, to report information not directly reported on Form 1040-SR. TurboTax Premier .

]]>